- Home

- Views On News

- Mar 6, 2024 - Why Bajaj Finance Share Price is Falling

Why Bajaj Finance Share Price is Falling

Editor's note: Extending its weak performance in 2024 so far, Bajaj Finance share price declined 2% in early trade on 6 March 2024.

This comes on top of a 5% fall seen in the previous session.

With this fall, the Bajaj group company has now fallen around 15% YTD.

The main reason behind this decline is weak Q3 results posted by the company a month ago.

The fall also coincides with the introduction of new Reserve Bank of India (RBI) regulations on risk-weight norms and embargoes on EMI cards, e-commerce loans, etc.

With Bajaj Finance being a favourite among retail investors, questions have been raised as to how long will the subdued performance continue and what lies ahead for the NBFC major?

Back when Bajaj Finance reported its Q3 results and shares dropped, we covered a detailed editorial explaining the reasons behind the same and what lies ahead.

Continue reading...

Why Bajaj Finance Share is Falling

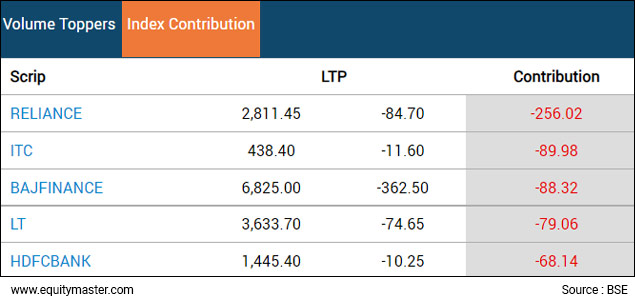

Bajaj Finance was among the top contributors that sparked a fall in Indian share market today.

Top Contributors that Caused a Fall in Indian Market

As the company's earnings took a reality check in the third quarter, this was bound to happen.

Bajaj Finance, which has consistently reported rising operating margins, saw its margins shrink this time.

In intraday trade, shares of the company fell 5% to Rs 6,825.

The stock price has underperformed in recent months, especially since Jio Financial Service made its market debut.

Let's look at why Bajaj Finance share price is falling and what lies ahead for the bluechip stock in 2024.

#1 Concerns Around Asset Quality

During the third quarter ended December 2023, Bajaj Finance reported higher loan losses and provisions.

The higher provisioning impacted profits as is non-performing assets (NPA) increased.

The gross non-performing assets (GNPA) increased by 0.95%.

The company also failed to beat profit estimates that Dalal street experts had projected.

Bajaj Finance on Monday reported 22% growth in its consolidated net profit at Rs 36.4 bn for the third quarter.

The company's net interest income (NII) was up by 29.3% to Rs 76.6 bn.

During the management commentary, the company expressed concerns about rural areas. It said that loan losses are very high in rural areas.

Along with that, collection efficiency in urban areas remained low during the December 2023 quarter.

Not just in rural areas, loan losses are also higher in urban areas due to low collection efficiency.

Apart from that, Bajaj Finance is currently also facing a ban from the RBI. The management said this has impacted its digital business (Insta EMI).

The digital EMI card acquisition segment saw a 31% decline while B2B loans also declined.

What Next?

Weak Q3 results led to the current fall in Bajaj Finance shares.

But the company has been facing a hard time ever since Mukesh Ambani's Jio Financial Services made its market debut.

It has also come under several observations by the Reserve Bank of India (RBI).

In October last year, the central bank imposed a penalty on the company for non-compliance with the rules.

With Jio Financial Services entering the consumer lending space, Bajaj Finance is facing direct competition.

To overcome this challenge, the company announced a mega fund-raising plan last year.

It raised funds worth Rs 100 bn (US$ 1 bn) through Qualified Institutional Placement (QIP) and from its parent company.

Here's what co-head of Research at Equitymaster Tanushree Banerjee wrote in her editorial...

- What typically happens in the case of fund raising plans of financing entities is that the new funds go straight to the book value of the company (assuming its only equity funding).

So, stocks that are valued on the basis of book value are automatically re-rated. At times if the return ratio is expected to get diluted the stock may also trade at a discount.

For Bajaj Finance, the proposed fund raising could account for around 15% of its current networth. Also, it could temporarily dilute its return on equity by 2%.

So, one can expect the incremental impact of this funding on the valuation of the stock, to be about 10% to 13%.

This certainly makes the stock appear relatively more attractive to long term investors.

However, please keep in mind that such temporary spurts in valuation metrics can be misleading.

Bajaj Finance is currently concentrating on launching new products and establishing physical offices across the country to improve its geographical presence.

Recently, it added new car financing and medical equipment financing to its portfolio.

In the last five years, the company's revenue has grown at a CAGR of 19.5%, driven by growth across segments, including mortgages, home loans, SME loans, and rural financing.

The net profit also grew at a CAGR of 23.6% during the same period. Its RoE has consistently improved and currently stands at 21.4%.

The company's net NPA also decreased drastically from 0.9x to 0.4x in the last year, showing its superior asset quality.

Going forward, the big bang expansion plan could drive its growth.

For more, check out Tanushree's video on Bajaj Finance:

How Bajaj Finance Share Price has Performed Recently

In the past one month, Bajaj Finance share price has fallen by 7%.

Today, the stock fell over 5% in intraday trade on the BSE.

Bajaj Finance has a 52-week high of Rs 8,190 touched in October 2023 and a 52-week low of Rs 5,487 touched on 20 March 2023.

Here's a table comparing Bajaj Finance with its peers.

Comparative Analysis

| Company | Bajaj Finance | AB Capital | M&M Financial | Chola Invest |

|---|---|---|---|---|

| ROE (%) | 23.7 | 27.3 | 11.7 | 20.6 |

| ROCE (%) | 11.8 | 11.6 | 8.8 | 9.7 |

| Latest EPS (Rs) | 212.3 | 20.1 | 16.1 | 38.3 |

| TTM PE (x) | 33.9 | 8.4 | 17.4 | 32.2 |

| TTM Price to book (x) | 6.5 | 1.8 | 1.9 | 5.5 |

| Dividend yield (%) | 0.4 | 0 | 2.2 | 0.2 |

| Industry PE | 27.1 | |||

| Industry PB | 2.9 | |||

About Bajaj Finance

Bajaj Finance is a deposit-taking non-banking finance company (NBFC) with a diversified loan portfolio and a pan-India presence.

While the company was originally set up to provide finance for the purchase of two-wheelers and three-wheelers manufactured by Bajaj Auto, it diversified into other segments over the years.

To know more about the company, check outBajaj Finance company fact sheet and Bajaj Finance quarterly results.

You can also compare Bajaj Finance with its peers.

Bajaj Finance vs Cholamandalam Invest

Bajaj Finance vs Edelweiss Financial

Happy Investing!

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "Why Bajaj Finance Share Price is Falling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!